Relative Strength Index RSI Calculation & Limitation

Contents

This indicates the reversal of the downtrend with the bearish trend losing its grasp in the market. A bearish divergence is observed when the prices make a new high while the RSI oscillator refuses to reach a new high. The bearish divergence means the bulls are losing momentum and the bearish trend is about to start. Needless to say, this is a signal to sell off and exit from the market. Like for any other indicators, results of RSI indicator is most reliable when it conforms to long term trends. Actual reversal signs are rare and need to be filtered from false signals.

The RSI may linger in overbought or oversold territory for lengthy periods of time during strong movements. For that, we need to understand another term called Divergence. A divergence is when the price of an asset moves in the opposite direction of a technical indicator. We already know that the price can either move up or down.

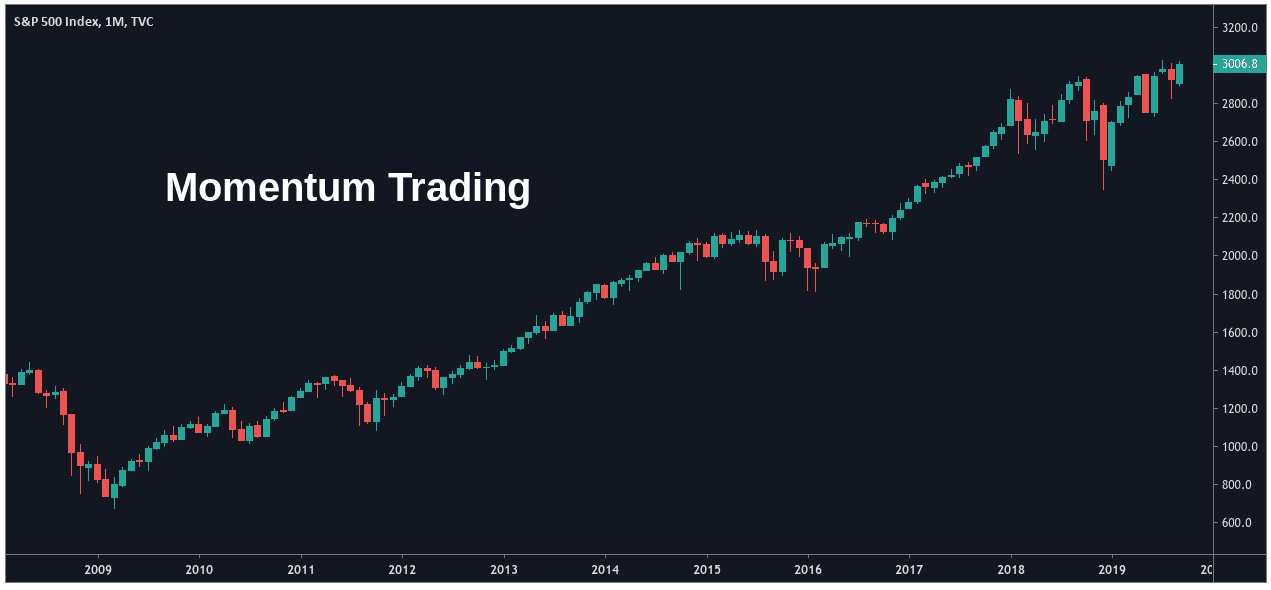

This Is Illustrated In The Chart Below

Prevent Unauthorized Transactions in your demat / trading account Update your Mobile Number/ email Id with your stock broker / Depository Participant. You must have come across price charts displayed on trading terminals. These price charts usually have lines plotted in smaller panels above and below them.

Another point worth mentioning is that, like all indicators and oscillators, the RSI also works on all time frames. The more skilled and disciplined traders use RSI to compare sectors first and then within it they use it to compare stocks. Let’s now look at the orange line, which originated when RSI touched a best value stocks to buy now india low of 30. But the second time, though, prices moved marginally lower, RSI did not even touch the 30 marks. It calculates the average percentage gain and average loss made over the last 14 days and divides the two. Using smoothening techniques, we arrive at an RSI figure which is anywhere between 0 and 100.

How to calculate average gain or loss

Do not trade in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. Update your e-mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. Increasing the setting makes the indicator less sensitive and shows few instances of overbought and oversold conditions. Most traders do not change the standard setting from 14, as this is the level that gives them the most valuable and reliable information. RSI convergence is generally formed when the price is falling.

The one with the highest RSI would mean that it is trading at the highest level from where it was 14 days back. He then digs deep into the sector and looks at the companies in the sector and sorts them on the basis of RSI. Here again, he is keen only on the top ones or the strongest ones. The chart shows that every time the price touches the 30 levels; it bounces back, sometimes for a short duration but on others, it is an important turning point. The message here is that the market respects this oversold line, with a number of participants placing their bets to go long on it.

- RSI comes in handy while picking entry and exit points in traders and also in maintaining stop losses.

- Momentum oscillators are one such set of tools that help traders understand the strength of a price trend.

- Using the RSI version that we suggest yields the best results.

- Neural networks are a powerful tool for analyzing and predicting financial data.

- The key to knowing is what phase of the market we are in.

Sometimes the overbought condition will be extended above the level like 75/25 or even 80/20 levels to mark overbought and oversold situations. Typically, indicators are of two types, leading and lagging. In other words, the latest RSI number incorporates the movement of the past 14 days and throws up a number based on the strength or weakness of the market. Thus, if all the recent 14 days have had a positive closing, we would be closer to an overbought situation while if all 14 days are negative, the RSI would be a number closer to the oversold line.

Sah Polymers Limited IPO – Price, Lot size, Open date, GMP & Review

Technical analysis is critical for trading nowadays if the trader maintains it simple and follows all trading principles as outlined in this paper. RSI indicators can show the price momentum and the trends followed by the stock based on such momentum. However, it cannot be considered as a sole indicator of price velocity and predicting the price trend. RSI indicator, as mentioned above, is the momentum oscillator that was first introduced by J. This is a technical analysis indicator that shows the speed of the changes in the prices of various instruments like stocks, commodities, futures, bonds, etc.

Your ads will be inserted here by

Easy AdSense.

Please go to the plugin admin page to

Paste your ad code OR

Suppress this ad slot.

To screen one, there are various factors that you can take into consideration such as market cap, volumes, etc. However, checking the momentum indicator would definitely help you screen stocks. One of the most popular momentum indicators is the Relative Strength Index . When a stock is in continuous downtrend, RSI will remain stuck in the oversold region as it cannot go below 0. Hence traders should not buy inspite of strong oversold RSI signal as the stock might keep climbing down following its downtrend. Decreasing the setting makes the indicator more sensitive and shows more instances of overbought and oversold conditions but provides more false signals.

Similarly, in a bear market between 10 and 60 range, the region between 50 and 60 acts as resistance. It gives details such as, double tops or double bottoms which a line chart can’t explain. Further, it also throws lights on the support or resistance level of stock. Conversely, when RSI registers lower high and lower low against higher high and higher lows of the price line, a negative divergence happens.

A major mistake some investors commit is to confuse the Relative Strength Index with Relative Strength. Although both the names sound the same, they are entirely different in their definitions and calculation. But sometimes, you might come across situations where the RSI has started to diverge from the stock price.

RSI shows zero value when the Average Gain value equals zero. For example, on 14 days period, RSI zero is an indication that price movement has been lower for the period, and there is no gain to measure. Like RSI, the concept of momentum oscillator was first introduced by J. Welles Wilder in his celebrated book, New Concepts in Trading Systems. To understand RSI, one must also understand what and how momentum oscillator works since the two indexes are used together to predict when market sentiment is shifting.

We at Enrich Money do not provide any stock tips to our customers nor have we authorised anyone to trade on behalf of others. If you come across any individual or organisation claiming to be part of Enrich Money and providing such services, kindly intimate us immediately. RSI begins to approach the 70 level – likely that the uptrend is ending.

The investors owe their success to technical indicators such as the Relative Strength Index which they use to execute Trend Trading. On the downside, when theNifty 50Index hits below 30, we again see a red shaded region. This region is theoversold zone.Once a security hits oversold levels we can see a trend reversal from that point.

Trend identification with the relative strength index (RSI) technical indicator –A conceptual study

The Relative Strength Index is a prominent technical indicator that helps traders identify possible buy entry opportunities and sell entry points ). Divergence signs of a likely forthcoming trend shift are also regularly monitored. The 14-day RSI of stock prices of Reliance Power in NSE.

In fact this is how you develop your edge as a trader. You need to analyze what works for you and adopt the same. The illustration above shows that with the setting at half the standard rate, the indicator line switches between overbought and oversold more often.

Then there will be Potential ample opportunities advisable. This can determine when a current trend may be coming to an end or when a new trend may be forming. Before we discuss this lesson, we need a prior understanding of the Indicators. https://1investing.in/ The blog posts/articles on our website are purely the author’s personal opinion. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice.

While 70 and 30 are the two absolute confirmation levels, the movement of RSI towards these levels can also be considered as an entry or exit point. That said, most new-age trading platforms have inbuilt services that display the RSI and RSI lines on your screen when you select the options. Since RSI measures the strength with reference to a given point, chances are that prices will make new highs but RSI will not, or on the other hand prices will touch new lows before RSI does.